How to Start a Rainy-Day Fund—Without Feeling Deprived

Saving Money Without Living Like a Monk

Let’s be real. The phrase rainy-day fund doesn’t exactly spark joy, does it? It sounds like something your nan would have tucked away in a biscuit tin, right next to the ‘emergency’ tea bags. The idea of stashing money away just in case can feel like yet another thing on the to-do list, somewhere between organising the airing cupboard and finally dealing with that junk drawer.

And let’s not even get started on the word saving. It conjures up images of sacrifice—skipping coffees, never going out, and generally living like a Victorian pauper just so you can feel smug about a bank balance you’re too scared to touch.

But here’s the thing: saving doesn’t have to be miserable.

It’s entirely possible to build up a rainy-day fund without living on gruel and saying no to everything fun. In fact, it can be downright satisfying. Stick with me, and I’ll show you how to squirrel away money so painlessly that future-you will be raising a glass in your honour.

Why a Rainy-Day Fund Actually Matters

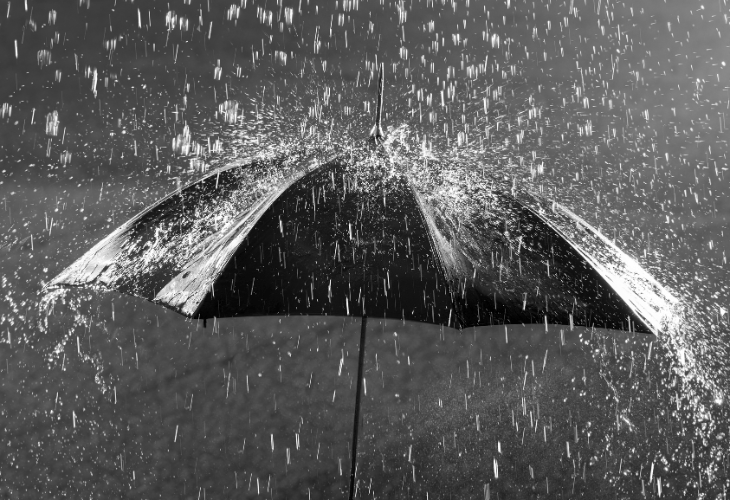

Picture this: your washing machine dies spectacularly in the middle of a load, your car develops a sound that can only be described as ominous, or your cat swallows something mysterious and now requires a small fortune in vet bills. Life happens, and sometimes, it happens in the most expensive way possible.

A rainy-day fund isn’t about being a boring, ultra-prepared person who thrives on financial spreadsheets and the thrill of not spending money. It’s about buying yourself peace of mind. It’s the difference between handling a crisis like a cool-headed queen or having to scramble around, panic-Googling ‘Can I pay a plumber in biscuits?’

And the best bit? You don’t have to be rich to do this. You just need to be a little bit sneaky.

Saving Money on the Sly (So You Barely Notice It’s Happening)

The trick to pain-free saving is to make it invisible. The less you feel the money leaving your account, the more likely you are to let it build up instead of raiding it at the first sign of temptation (yes, that means you, standing in the homeware aisle cradling a cushion you definitely don’t need).

Start by setting up a separate account for your rainy-day fund—one that isn’t linked to your everyday banking app, so you’re not constantly looking at it and thinking hmm, that’s enough for a weekend away... If possible, automate a tiny transfer every time you get paid. Even a fiver here and there adds up, and because it happens without you having to do anything, you won’t even register the loss.

For extra stealth, round up every purchase you make and sweep the difference into your savings. Spent £2.80 on something? Stick that extra 20p into your rainy-day fund. It’s the digital equivalent of chucking loose change into a jar, except you don’t have to faff around with actual coins.

Small Changes That Stack Up (Without Ruining Your Fun)

If the thought of ‘cutting back’ makes you want to lie down in a dark room, don’t worry—I am not about to tell you to cancel all your streaming services and start hand-washing your clothes to save on electricity. Instead, let’s talk about tweaks that make no difference to your daily happiness but a huge difference to your bank account.

Start by tackling your direct debits. There’s a high chance you’re still paying for something you don’t even use. That long-forgotten subscription? That slightly-too-fancy gym membership? If you don’t love it, cancel it and redirect that money to your savings instead.

Next, take a look at the sneaky spending that doesn’t actually bring you joy. The stuff you buy out of habit rather than actual want. That fourth takeaway coffee of the week? That random ‘treat’ from the supermarket that ends up at the back of the fridge? If it’s not making your life noticeably better, swap it for a cheaper alternative and stash the savings.

And for the truly lazy approach (my personal favourite), put any unexpected money straight into your rainy-day fund. Birthday money, refunds, that weirdly small tax rebate you weren’t expecting—if it’s extra, it’s savings. No effort required.

Building the Fund Without the ‘Fun Deficit’

Here’s the part most financial advice gets wrong: you can’t just cut and cut and cut until you’re down to the bare minimum. That’s a one-way ticket to misery, and the second you feel deprived, you’ll undo all your hard work by panic-spending on something extravagant just to feel alive again.

The key is balance. You should be able to put money aside without feeling like you’re living in a state of permanent restriction. Think of it like meal planning: if you force yourself to eat plain salad for a week, you’ll eventually snap and inhale an entire cake. But if you build in treats that don’t break the bank, you’re far more likely to stick with it.

This means saving while still allowing yourself the things that actually make you happy. Love a nice coffee? Keep it in the budget, but make it a conscious choice rather than an automatic daily habit. Enjoy a takeaway on a Friday night? Great—maybe swap one of them out for a homemade ‘fakeaway’ and pocket the savings.

The goal isn’t to hoard every penny like a Victorian miser. It’s to create a system where saving happens without making life dull.

Future-You Will Thank You

Here’s the best bit about a rainy-day fund: once it starts growing, it feels really, really good. There’s nothing quite like the satisfaction of knowing you’ve got a cushion between you and whatever life decides to throw your way next. It’s freedom—the ability to handle an emergency without derailing everything else.

And if you’re thinking, this all sounds great, but I could do with a bit of a nudge, you’re not alone. That’s exactly why we created The Crofties community—to share tips, swap ideas, and keep each other motivated to build savings without sacrifice. Come and join us. Your future self will be chuffed to bits.

START HERE

The Urban Crofters Manifesto

... How to Build a Life of Creativity, Resilience & Financial Freedom!

The Patchwork Income Revolution

.. How Smart Women Weave Multiple Income Streams into a Sustainable Future!

Women Who Grow Together

... Why Community is the Key to Thriving in Midlife & Beyond

ABOUT ME

Hi there 👋 My name is Elaine Colliar and welcome to The Urban Croft—a space for creativity, resourcefulness, and financial freedom.